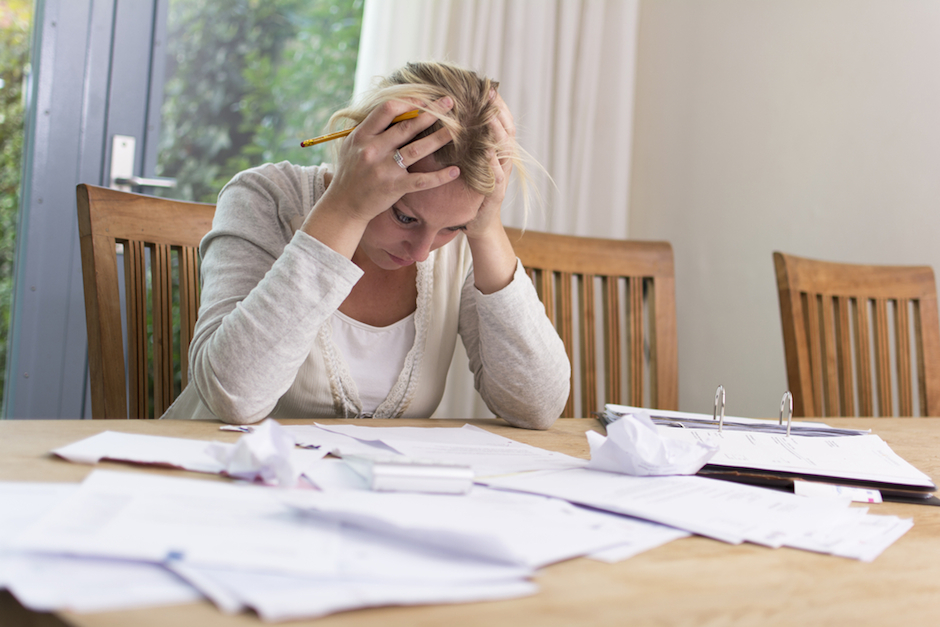

You have a mortgage which is why you're probably asking this question, so the logical leap is you have a mortgage because you either don't have the financial resources not to or you wish to leverage your capital for the maximum return. Either way you have taken on a financial risk by having a mortgage.

If things go to plan and nothing happens to you or your property then the risk has not been realised, the question then becomes what if the risk is realised?

Mortgage Protection Insurance is how you go about mitigating this particular financial risk.